5 Ways to Improve Your Credit Score

Your credit score is the key to determining the interest rate you pay on a mortgage. Here are ways you can improve your score to get the best rate possible.

Pull Your Credit Score and Credit Reports

Every year it’s a good idea to see your credit report. You can visit Annual Free Credit Report or check your credit on Credit Karma.

Fix Errors and Incorrect Information

If you find any errors on your credit report, you can dispute them with the credit bureaus. The credit bureaus are required to investigate your dispute and remove any errors that they find. Some common errors are identity information, accounts reporting, credit limit and payment history.

Pay Down Debt

Not all debts is inherently bad, but having a lot of revolving debt (like credit cards) makes you less appealing to lenders. Pay off as much as you can, and consider asking for higher credit limits. Higher limits will improve your credit utilization as long as you don’t increase your balance to match.

Don’t Miss Payments

Even a few missed payments can bring down an otherwise excellent record. Make sure all accounts are current, and pay up any past-due accounts status.

Don’t Apply for Too Much Credit

Applying for a lot of loans and cards generates hard credit inquiries which show up on your credit report and can make you look a bit desperate.

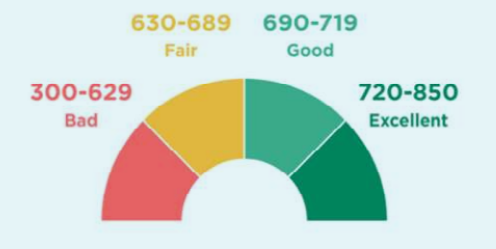

What is a Good Credit Score?

The chart bellow shows how credit scores are ranked.

Mortgage 1 Is Here to Help

Credit can seem trickly and confusing. But the main things are paying on time,using credit regularly and responsibly and payment history.

We at Mortgage One, help with clients everyday with their credit. If you have questions, please let us know. We are the lender buyers trust most. Our customer service is second to none and our digital tools make the process easy. We can help you. Call or contact us today to see how we can help.

How We Can Help??

𝙂𝙧𝙤𝙪𝙥 𝙩𝙤 𝙇𝙚𝙖𝙧𝙣 𝙀𝙑𝙀𝙍𝙔𝙏𝙃𝙄𝙉𝙂 𝘼𝙗𝙤𝙪𝙩 𝘽𝙪𝙮𝙞𝙣𝙜 𝙖 𝙃𝙤𝙢𝙚 𝙞𝙣 𝙈𝙞𝙘𝙝𝙞𝙜𝙖𝙣

𝘽𝙪𝙞𝙡𝙙 𝘾𝙪𝙨𝙩𝙤𝙢𝙞𝙯𝙚𝙙 𝙃𝙤𝙢𝙚 𝙋𝙪𝙧𝙘𝙝𝙖𝙨𝙚 𝙋𝙡𝙖𝙣

Call or Text us at 313-214-2400

Tim Tomkowiak

“I am a license loan officer. And I help ordinary people build equity and wealth through home ownership”